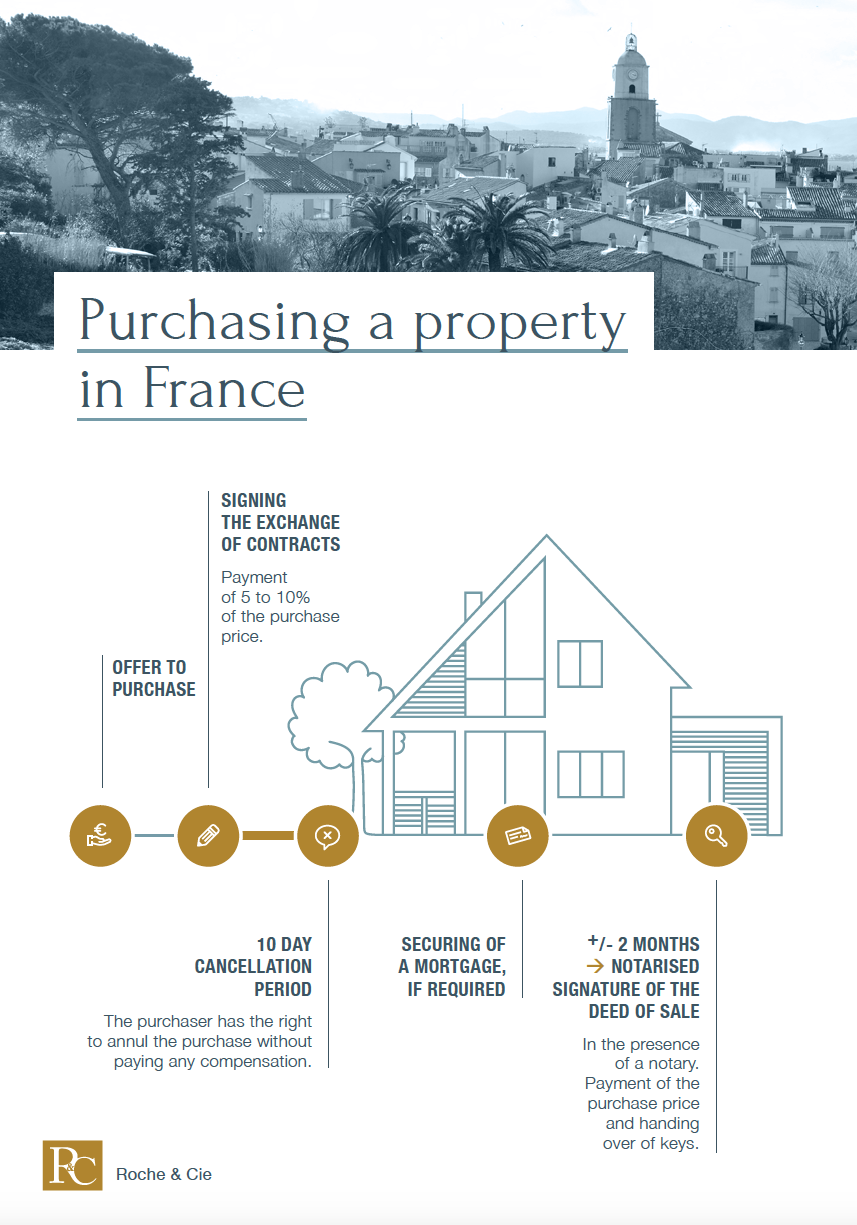

FROM VISITING A PROPERTY TO SIGNING THE FINAL DEED • FOUR STEPS TO BUYING A PROPERTY IN FRANCE

Step 1: the offer to purchase

Step 1: the offer to purchaseStep 2: the notary's choice

Step 3: the compromise or the promise of sale

> About the buyers

> About the seller

Step 4: Notifying the Compromise or Promise to the Purchaser

Step 5: The loan offer

> Acceptance of the loan offer

Step 6: the bill of sale Step

7: the award ceremony

STEP 1: THE OFFER TO PUPCHASE

After several months of research, the DURAND couple found an apartment in an 18th century building located in the 9th district of Paris. They intend to finance their purchase of 430 000 € by means of a loan of 300 000 €, their savings being used to pay the commission of the agency, the deposit of guarantee and the expenses of act.

The real estate agent asks them to make an offer to buy from the seller. They want to know if that entails them.

Yes, the firm and unreserved purchase offer commits the person who establishes it. This is a common practice but not mandatory.

In this offer, Mr and Mrs DURAND propose to their salesman to buy his apartment at a price (equal to or lower than that which he asks for) and conditions determined. To avoid being bound too long by their proposal, the DURAND spouses have an interest in limiting it in time. They will not be able to withdraw it before the expiry of the planned date.

If the seller does not accept their offer within the deadline, Mr. and Mrs. DURAND regain their freedom. If, on the contrary, the offer is accepted under the conditions proposed (price, ...), they are required to sign a preliminary contract (promise or compromise of sale).

STEP 2: THE NOTARY'S CHOICE

After having accepted the offer of Mr. and Mrs. DURAND, the salesman proposes to them to contact his notary to fix an appointment of signature of the compromise of sale. Mr. and Mrs. DURAND are wondering if they can also use a notary. Yes, the seller and the buyer can each appeal to their notary at no additional cost to the purchaser.

STEP 3: THE COMPROMISE OR THE PROMISE TO SALE

The notary in charge of the sale, invites the seller and the DURAND couple to a signature appointment. He sends them the RIB of the Notarial Office and asks them to transfer the sum corresponding to 10% of the purchase price and the costs of drafting the sales agreement. He asks the seller to make realize for this date various diagnoses on the property. The seller and the husband and wife are wondering if this is a common practice?

About the buyers

In return for the seller's commitment, it is customary for the purchaser to pay a deposit. It is usually 10% of the purchase price. This amount can be freely decreased. This sum corresponds either to an advance on the price if the sale is made, or to a compensation of the seller if the purchaser does not want to sign the definitive act. As of January 1, 2015, all payments over € 3,000 (previously € 10,000) received or issued by a notary on behalf of the parties to a deed received in the authentic form and giving rise to land registration are obligatory be made by bank transfer. Notaries can no longer accept checks (even bank checks), for the payment of notarial deeds giving rise to land registration they establish. Failure to comply with these obligations is punishable by a fine.

About the seller

Yes, he has the obligation to have a technical diagnosis file drawn up. He must submit this file to the notary before the signing of the agreement or the promise of sale in order to allow the DURAND couple to be informed of the condition of the property. In the absence of such documents, the seller could be held responsible for any defect not apparent that the purchaser could not detect alone. When selling a lot of condominiums, specific documents must be communicated by the seller at the time of the preliminary contract.

STEP 4: NOTIFYING THE COMPROMISE OR PROMISE TO THE PURCHASER

The DURAND spouses are wondering if they are finally engaged by the signing of the preliminary contract and if the amount paid will be returned to them if they change their minds?

NO. Purchasers have the right to retract for a period of 10 days from the day after the notification of the preliminary contract by hand, by registered letter with acknowledgment of receipt or by bailiff. They do not have to justify any reason and will then be able to fully recover their deposit. The recipient of the withdrawal is in principle the seller. When an intermediary has intervened (real estate agent, notary), it is better to notify him also.

For the sale of a lot of condominiums, the withdrawal period or reflection period begins to run the day after the communication of specific documents to the purchaser. The required documents may be delivered by hand delivery of a paper copy; a USB key; a CD-ROM; by receiving an e-mail or by delivering to a download site.

STEP 5: THE LOAN OFFER

The notary has informed Mr and Mrs DURAND that a delay of approximately 3 months is necessary before the signing of the definitive deed of sale. He explained to them that during this time, they must get closer to their bank to get their loan. They fear to be permanently engaged while they are not insured at this stage to get their loan. Whether the buyer uses a loan or not, the deed of sale must mention an indication of the financing. When the act indicates that the price is paid by means of a mortgage loan (governed by the provisions of the consumer code on the mortgage loan - example: an individual who makes a loan to buy his principal residence), it must contain a condition precedent legal obtaining real estate loans.

If the DURAND spouses do not obtain their credit before the date indicated in the preliminary contract, they have the choice to continue the sale (if they have another source of financing) or to give it up. In the latter case, they recover their deposit unless they are in bad faith (for example, if they make a request exceeding their financial capacity or not in accordance with the forecasts of the pre-contract). If the DURAND spouses do not obtain their credit after the date indicated in the preliminary contract, they must obligatorily continue the sale.

Attention: if the purchaser does not intend to solicit a loan, he must affix a specific handwritten mention to that effect. If the compromise or the promise of sale has been received by authentic instrument, there is no obligatory mention.

Acceptance of the loan offer

The buyer has a minimum period of 30 days to obtain a loan in accordance with the conditions stipulated in the preliminary contract (amount, duration, rate ...). In practice, this period is generally extended to 45 days in the compromises. Once the loan offer has been issued by the bank, the borrower can not accept it before the expiration of 10 days after receipt. The sale itself can not be signed before this term. The notary for his part verifies a certain amount of information: if the seller is the owner, the previous title deeds, the situation of the property with regard to the planning rules, easements, the mortgage situation of the property ... Sometimes the property is located in an area where the municipality can exercise an urban right of preemption. This means that it is a priority, for 2 months (3 months in some cases), to acquire it in order to carry out a project of general interest. Before the expiry of this period, the deed of sale can not be signed. All these steps justify the time between the pre-contract and the final sale.

STEP 6: THE BILLE OF SALE

Mr. and Mrs. DURAND got their loan. The notary contacts them to inform them that the file is complete and to offer them a signature appointment. He asks them to make a transfer corresponding to the balance of the sale price and a provision for expenses. How is the sale going? On the day set for the signature, the DURAND couple go to study. Also present are the seller, his notary and the real estate agent. The notary reads the document to them. Mr. and Mrs. DURAND are very attentive and do not hesitate to ask questions to be sure to understand the scope of their commitment. The seller gives them the keys in return for full payment of the sale price to the notary.

STEP 7: THE AWARD CEREMONY

The seller is surprised that the full sale price is not given him. The delivery of the sale price to the seller assumes the payment of the price by the purchaser. The notary explains to him that he must repay the current mortgage on the property, keep a provision necessary to perform the act of release ... Only the sum available after these deductions may be remitted to him. The notary then gives the seller and the purchasers a certificate of sale. He indicated to Mr. and Mrs. DURAND that they will receive their title of property and the definitive account of the expenses related to the sale after the completion of the formalities of publicity with the conservation of the mortgages.

Source: Notaries of Paris

Copyright 2017 SAS BENJAMINPRATT - Any reproduction prohibited