THE END OF THE WEALTH TAX AND THE CREATION OF A NEW WEALTH TAX ON REAL ESTATE…

The 2018 finance bill (hereinafter referred to as “PLF”) is currently under discussion in the French Parliament. It should be adopted before the end of the year and will enter into force on January 1, 2018.

Among the various measures (including the introduction of a "flat tax of 30%" on certain financial income), the abolition of the property tax and the introduction of a new property tax is a minor tax revolution (at least for French tax residents).

This new tax would be codified in accordance with art. 964–983 of the General Tax Code.

Let us examine the main consequences of this new tax for non-French tax residents who wish to buy or already own residential properties in France. This article, reserved for non-residents only, will therefore not deal in detail with the new provisions.

For non-residents, the tax would only apply to buildings located in France which are not used for professional activities.

This mainly concerns residential real estate: second homes in France for non-residents. The situation would not change compared to the current wealth tax.

Furnished rental activities should not be considered professional activities, unless the property is used for the professional activities of the person responsible (rare for non-residents).

Unlike the ISF, all other goods in France would be excluded (furniture, car or boat registered in France, etc.).

Taxation will also apply to securities of French and foreign companies with direct or indirect residential property in France (it does not matter whether the company is considered to be a real estate company).

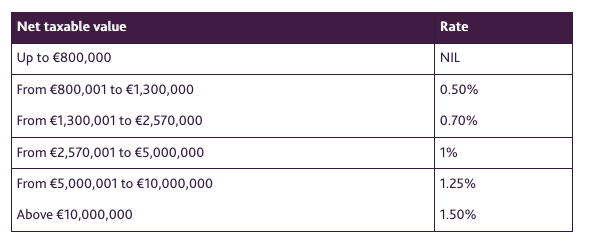

As in the case of ISF, the tax would have been due if the net value of the taxable property had exceeded the threshold of EUR 1 300 000.

In this case, the progressive tax rates would remain unchanged:

The principle of taxation of the market value of the property would remain (with a reduction of 30% for the main residence, but does not apply to non-French tax residents).

In the case of corporate securities, the procedures for determining the value of the shares would remain unchanged. The current accounts of associated companies would still not be used to determine the value of the securities.

The changes should be the biggest in counting debts. PLF indeed provides for more restrictions.

Only loans taken out for the purchase, improvement, construction and renovation of taxable property can be deducted.

The PLF defines the conditions for deducting debts. To be deductible, debts must, as they are today, relate to taxable assets, exist on January 1 of the taxation year and be effectively contracted by the obligated person. The debt must also be justified. The law does not provide

another condition for the deduction of debts. In particular, nothing in the legislation indicates that in order to be deductible, the debt (in this case a bank loan) must be guaranteed by the real security of the property it finances.

PLF anticipates that loans in the form of fines will only be partially deductible. However, family loans and controlled business loans cannot be deducted. Certain family loans can be deducted provided that they are granted under normal conditions. It is unclear whether these restrictions will apply to business loans.

In addition, these new restrictions should only apply to loans made on or after January 1, 2018 (but this must be confirmed).

Finally, PLF provides for a credit deduction limit when the taxable value exceeds EUR 5,000,000 and the amount of the debt exceeds 60% of the taxable value. Some loans exceeding this limit can only be deducted up to 50%. Imagine buying a house for 8,000,000 EUR with a loan of 6,000,000 EUR. The loan exceeds 60% of the property value, i.e. 4,800,000 EUR. The excess of EUR 1,200,000 can only be deducted up to EUR 600,000. The amount of deductible debt would then be limited to EUR 5,400,000. This limit should not apply to loans made directly to the business.

Here are the main measures of the wealth tax, particularly interesting for tax residents outside France. Of course, the PLF is currently under discussion in Parliament. The new tax has already been approved by the National Assembly and must be approved by the Senate. These rules can still be changed, but in general, the economics of the project should not be fundamentally affected.

Source: Gowling WLG - Frederic Mege - Associé, Tax

Copyright 2017 SAS BENJAMINPRATT - Any reproduction prohibited